UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | |

| ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| Preliminary Proxy Statement | ||

| Confidential, | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material | ||

Southern California Edison Company

(Name of Registrant as Specified In Its Charter) 2018 Joint Proxy Statement Notice of Annual Meeting Mailing address of the executive offices: March Dear We are pleased to invite you to attend the Edison International and Southern California Edison Company Annual Meeting of The Proxy Statement Our Mission Our mission is to Board Composition and Diversity At the Annual Meeting, shareholders will vote on whether to re-elect each of our directors. We value the diversity of skills, backgrounds, gender and ethnicity on the Board, as six of our director nominees are either female or ethnically diverse. In 2017, we welcomed Michael Camuñez and Timothy O’Toole to the Board.Mr. Camuñez, who joined in June, is president and chief executive officer of Monarch Global Strategies LLC, which provides strategic advice and advocacy to companies doing business in emerging economies. Mr. O’Toole, who joined in August, is the chief executive officer of First Group plc, a transportation company that provides rail and bus services in the United Kingdom and North America. They join a Board comprised of accomplished leaders with diverse perspectives on the Company’s business and strategy. Strategy Oversight One of the Board’s key responsibilities is oversight of the Company’s strategy. The electric power industry is in the midst of a profound transformation toward a low-carbon future as a response to climate change. The Board is regularly engaged in providing management with strategic direction to help position the Company to lead this transformation, focusing on opportunities in clean energy, efficient electrification, strengthening and modernizing the electric grid, and customer choice. We encourage you to learn more about our strategy in the Proxy Statement and on our website. Executive Compensation At the Annual Meeting, shareholders will also provide an advisory vote on whether to approve our executive compensation. As discussed in the Proxy Statement, our executive compensation program is designed to strongly link pay with performance, providing for a mix of base salary and annual and long-term incentive compensation. The Board believes our executive compensation program serves our shareholders well. Your Vote is Important If you receive more than one copy of the Notice of Internet Availability of proxy materials or more than one Proxy Card, it means your shares are held in more than one account. You should vote the shares in all of your accounts.Please note that to vote your shares by Internet or telephone you will need the control number on your Notice or Proxy Card. Your vote is very important to us and to our business. If you vote by Internet or telephone, please cast your vote by the April Sincerely, 2018 Proxy Statement Meeting Information Date Location EIX and SCE shareholders may also vote on any other matters properly brought before the meeting. Only shareholders at the close of business on The EIX and SCE Boards of Directors are soliciting proxies from you for use at the Annual Meeting, or at any adjournment or postponement of the meeting. Proxies allow designated individuals to vote on your behalf at the Annual Meeting.(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)Southern California Edison Company(Name of Registrant as Specified In Its Charter)(Name of Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check the appropriate box)PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):[X]☑ No fee required. [ ]☐Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ [ ]Fee paid previously with preliminary materials.materials:☐ [ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Formform or Scheduleschedule and the date of its filing.1) Amount Previously Paid:previously paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4)Date Filed:4) Date Filed:

Energy for What’s AheadSM

Energy for What’s AheadSMEdison International &

Southern California Edison Company

to be held on Thursday, April 28, 201626, 2018

2244 Walnut Grove Avenue

Rosemead, California 9177018, 201616, 2018 Fellow Shareholder:Shareholders toShareholders. The Annual Meeting will be held on Thursday, April 28, 2016,26, 2018, at 9:00 a.m., Pacific Time, at the Hilton Los Angeles/San Gabriel Hotel, 225 West Valley Blvd., San Gabriel, California 91776. During the meeting, we will report on the Company’s strategy and performance, and provide an opportunity for shareholders to engage in a dialogue with management.Proxy Highlightsincludescontains details of the business to be conducted at the Annual Meeting and provides information about the Board of Directors’ role in our corporate governance and executive compensation program. In particular, I would likedirect your attentionsafely provide reliable, affordable and clean energy to our customers. As part of this commitment, we have been working tirelessly to restore the following matterscommunities affected by the recent wildfires and mudslides in our service territory, prevent and fight future wildfires, and address the impact of climate change on our communities. The Board’s role in our response to wildfires and climate change is discussed in the Proxy Statement:Statement.●www.edison.com The qualifications, experience and diversity of our director nominees (pages 1-8);●Our key corporate governance attributes (page 2);●Our Board oversight of cybersecurity and environmental and social issues (pages 11-12);●Our engagement with major shareholders on corporate governance, proxy disclosure, executive compensation and environmental and social issues (pages 2 and 27);●Our adoption of a right for eligible Edison International shareholders to include director nominees in the Company’s Proxy Statement, commonly known as proxy access (pages 2 and 12); and●A proposal to amend the Edison International 2007 Performance Incentive Plan (pages 54-62).iThe proxy materials are being mailedWhether or provided tonot you via the Internet beginning on March 18, 2016. We hope that you will participate inattend the Annual Meeting, by attending and/or voting. Voting by any of the available methods will ensureit is important that you areyour shares be represented and voted at the Annual Meeting, even ifmeeting. We urge you are not present. You mayto promptly vote your proxy via the Internet, by telephone, or by mail. Please followsigning, dating and returning the instructions on the Notice of Internet Availability of proxy materials or Proxy Card thatif you received in thematerials by mail.2725 deadline (April 2624 for shares held in the Edison 401(k) Savings Plan).ThankOn behalf of the Board of Directors, thank you very much for your continued interestinvestment in our business.

Sincerely,

Theodore F. Craver, Jr.Chairman of the Board,Company.

William P. Sullivan Pedro J. Pizarro Independent Chair President and Chief Executive Officer President and Chief Executive OfficerEdison Internationaliii

Date:

Thursday, April 28, 2016Time:26, 2018

Time

9:00 a.m., Pacific TimeLocation:

Hilton Los Angeles/San GabrielHotel 225 West Valley Blvd. San Gabriel, California 91776 Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on April 28, 2016:The Proxy Statement and Annual Report are available atwww.edison.com/annualmeeting.Directions to the Annual Meeting and information on how to vote your proxy are included in the Proxy Statement.Items ToItems to Be Voted OnBy Edison

International

(“EIX”)

ShareholdersBy Southern

California

Edison Company

(“SCE”) ShareholdersBoard

Recommendation1.1 Election of Directors 10 Nominees 11 Nominees Jagjeet S. Bindra✓✓ForMichael C. Camuñez

For Vanessa C.L. Chang ✓

✓

For Theodore F. Craver, Jr.✓✓ForJames T. Morris ✓

✓

For Timothy T. O’Toole

For Kevin M. Payne —

For Pedro J. Pizarro

✓ForRichard T. Schlosberg, III✓✓

For Linda G. Stuntz ✓

✓

For William P. Sullivan ✓

✓

For Ellen O. Tauscher ✓

✓

For Peter J. Taylor ✓

✓

For Brett White ✓

✓

For 2 2.Ratification of the Appointment of the Independent

Registered Public

Accounting Firm✓

✓

For 3.3 Advisory Vote to Approve the Company’s Executive

Compensation✓

✓

For 4.Approval of an Amendment to the EIX 2007 Performance Incentive Plan✓For5.4 Shareholder Proposal Regarding Enhanced

Shareholder Proxy Access✓

— Against RECORD DATERecord DateFebruary 29, 2016March 1, 2018 are entitled to receive notice of and to vote at the Annual Meeting.SOLICITATION OF PROXIESSolicitation of Proxies

Dated: March 18, 2016

16, 2018

For the Boards of Directors,

Barbara E. Mathews

Vice President, Associate General Counsel,

Chief Governance Officer and Corporate Secretary

Edison International

Southern California Edison Company

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on April 26, 2018: The Proxy Statement and Annual Report are available atwww.edison.com/annualmeeting. Directions to the Annual Meeting and information on how to vote your proxy are included in the Proxy Statement. 2018 Proxy Statement Table of Contentsiiwww.edison.com iii

TABLE OF CONTENTSiv

PROXY SUMMARY

PROXY SUMMARY |

| The information below is presented to assist shareholders in reviewing the proposals to be voted on at the Annual Meeting. For more complete information about these topics, please review the Company’s complete Proxy Statement and Annual Report. |

Our Business Strategy, and Financial HighlightsClean Energy Strategy

EIX’s core business is conducted by its subsidiary SCE, a rate-regulated electric utility that supplies electric energy to an approximately 15 million people in a 50,000 square-mile area of southern California. Our mission isWe are building a modern electricity company that allows customers to safely provide customerstake control of their energy consumption by providing safe, smart, flexible, reliable, and affordable and clean electricity. Our strategy has three themes:services. We are focused on four strategic priorities:

| ● | |

| ● | |

| ● | |

| ● | Achieving operational and service excellence and doing so safely. |

This strategy, reviewed and overseen by the Board, is intended to provide a foundation for long-term sustainable growth and shareholder value.

We are also focused on supporting California’s goal to cut greenhouse gas emissions to 40 percent below 1990 levels by 2030 and ultimately to reduce emissions to 80 percent below 1990 levels by 2050. We believe in a clean energy future, and are developing smart solutions to society’s climate and energy challenges.

More information on our strategy is included in our Annual Report.

Shareholder Engagement on Environmental, Social and Governance (“ESG”) Issues

We regularly seek and value input from our shareholders. Each year we reach out to our major institutional shareholders to discuss the Company’s corporate governance, executive compensation, and business strategy. In 2017, we engaged with shareholders holding approximately 34% of EIX Common Stock to discuss, among other issues, our Board oversight and Company disclosure related to ESG issues. We received feedback on information used by shareholders to evaluate ESG practices and their desired disclosure. This feedback was shared with the Governance Committee.

After receiving feedback from shareholders and other stakeholders, we enhanced our voluntary ESG disclosure by participating in a pilot reporting template developed by Edison Electric Institute, the electric utility industry’s trade association, in collaboration with investors and member companies. The goal of the pilot is to provide investors and other stakeholders with relevant, comparable and easily accessible ESG data for electric utilities. Our template is available on our website atwww.edison.com/corporateresponsibility.

| www.edison.com | 1 |

Proxy Summary

Recent Developments

In December 2017, multiple wind-driven wildfires caused substantial damage to both residential and business properties in SCE’s service territory and service outages for SCE customers. The largest of these fires, known as the Thomas Fire, also resulted in two fatalities. The causes of the wildfires are being investigated by the California Department of Forestry and Fire Protection, other fire agencies and the California Public Utilities Commission (“CPUC”). We believe the investigations include the possible role of SCE's facilities. These investigations may take a considerable amount of time to complete.

In January 2018, torrential rains in areas affected by the Thomas Fire produced mudslides and flooding in Montecito, California and surrounding areas that damaged or destroyed hundreds of structures and resulted in at least 21 fatalities. However, it has not been determined whether the Montecito mudslides were caused by the Thomas Fire. For more information, see the Company’s Form 10-K for the fiscal year ended December 31, 2017 (“10-K”).

On January 30, 2018, SCE entered into a settlement agreement with consumer parties regarding issues and costs associated with the closure of the San Onofre Nuclear Generating Station (“SONGS”). If approved by the CPUC, the agreement would resolve all issues under consideration in the CPUC’s SONGS proceeding by revising the prior settlement it approved in 2014. For more information, see the Company’s Form 8-K filed with the SEC on January 31, 2018.

Financial Results

Significant financial results for EIX include:

| ● | |

| ● | 2017 consolidated core earnings of |

| ● | |

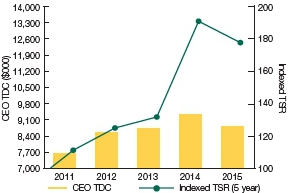

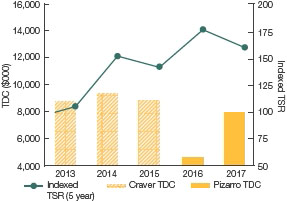

| ● | One-year (2017) total shareholder return (“TSR”) of |

| ● | |

| ● | |

Our The decline in our stock price in December 2017 negatively impacted our TSR for each period.

See theCompensation Discussion and Analysisbelow for information on how our executive compensation program aligns our executives’ earning opportunity with shareholder value creation.

| 2 |  | 2018 Proxy Statement |

Proxy Summary

Director Nominees

Our director nominees reflect the diversity of ethnicity, gender, skills, backgroundbackgrounds and qualifications valued by our Board. The range of tenure on our Board brings a variety of perspectives to strategic, financial and operational deliberations.

| Name | Director Since | Industry Experience | Ethnicity/ Gender | Independent | Committee Memberships | Other Public Co. Boards | Mandatory Retirement Date | |||||||||

| Jagjeet S. Bindra | 2010 | Energy | Asian/ | Yes | Audit | 2 | 2020 | |||||||||

| Male | FOSO | |||||||||||||||

| Vanessa C.L. Chang | 2007 | Accounting/ | Asian/ | Yes | Audit | 3 | 2025 | |||||||||

| Real Estate | Female | Compensation | ||||||||||||||

| Theodore F. Craver, Jr. | 2007 (EIX) | Electric Utilities | White/ | No | None | 1 | N/A | |||||||||

| 2008 (SCE) | Male | |||||||||||||||

| James T. Morris | N/A | Insurance | White/ | Yes | None | 1 | 2032 | |||||||||

| (New Nominee) | Male | |||||||||||||||

| Pedro J. Pizarro | 2014 | Electric Utilities | Hispanic/ | No | None | 0 | N/A | |||||||||

| (SCE Nominee Only) | Male | |||||||||||||||

| Richard T. Schlosberg, III | 2002 | Communications/ | White/ | Yes | Compensation | 0 | 2017 | |||||||||

| Publishing | Male | Governance | ||||||||||||||

| Linda G. Stuntz | 2014 | Law | White/ | Yes | FOSO | 1 | 2027 | |||||||||

| Female | Governance | |||||||||||||||

| William P. Sullivan | 2015 | Information | White/ | Yes | FOSO | 1 | 2022 | |||||||||

| Technology/ | Male | Governance | ||||||||||||||

| Biotechnology | ||||||||||||||||

| Ellen O. Tauscher | 2013 | Government/ | White/ | Yes | Audit | 2 | 2024 | |||||||||

| Finance | Female | FOSO | ||||||||||||||

| Peter J. Taylor | 2011 | Finance | African | Yes | Audit | 0 | 2031 | |||||||||

| American/ | Compensation | |||||||||||||||

| Male | ||||||||||||||||

| Brett White | 2007 | Commercial | White/ | Yes | Compensation | 1 | 2032 | |||||||||

| (Lead Director) | Real Estate | Male | Governance |

Audit = Audit CommitteeCompensation = Compensation and Executive Personnel CommitteeFOSO = Finance, Operations and Safety Oversight CommitteeGovernance = Nominating/Corporate Governance Committee

| Name | Age | Director Since | Industry Experience | Diversity | Independent | Committees Memberships | Other Public Co. Boards | Mandatory Retirement Date | ||||||||||||||

| AC | CC | FOSO | NGC | |||||||||||||||||||

| Michael C. Camuñez | 49 | 2017 | Law/ Government | Hispanic/ Male/LGBT |  |  |  | 0 | 2042 | |||||||||||||

| Vanessa C.L. Chang | 65 | 2007 | Accounting/ Real Estate | Asian/ Female |  |  |  | 3 | 2025 | |||||||||||||

| James T. Morris | 58 | 2016 | Insurance | White/ Male |  |  |  | 1 | 2032 | |||||||||||||

| Timothy T. O’Toole | 62 | 2017 | Transportation | White/ Male |  |  |  | 1 | 2028 | |||||||||||||

| Kevin M. Payne (SCE Nominee Only) | 57 | 2016 | Electric Utilities | White/ Male | — | 0 | — | |||||||||||||||

| Pedro J. Pizarro | 52 | 2014 | Electric Utilities | Hispanic/ Male | — | 0 | — | |||||||||||||||

| Linda G. Stuntz | 63 | 2014 | Law/Utility Regulation | White/ Female |  |  |  | 1 | 2027 | |||||||||||||

| William P. Sullivan (EIX Chair) | 68 | 2015 | Information Technology/ Biotechnology | White/ Male |  |  |  | 1 | 2022 | |||||||||||||

| Ellen O. Tauscher | 66 | 2013 | Government/ Finance | White/ Female |  |  |  | 1 | 2024 | |||||||||||||

| Peter J. Taylor | 59 | 2011 | Finance | African American/ Male |  |  |  | 0 | 2031 | |||||||||||||

| Brett White | 58 | 2007 | Commercial Real Estate | White/ Male |  |  |  | 0 | 2032 | |||||||||||||

| AC = Audit Committee |  | = Member | |

| CC = Compensation and Executive Personnel Committee |  | =Chair | |

| FOSO = Finance, Operations and Safety Oversight Committee |  | =Financial Expert | |

| NGC = Nominating/Corporate Governance Committee |

|  |

Proxy Summary

Corporate Governance Attributes

| Board Characteristics and Diversity | ||

| 90% | of EIX Directors are Independent | 40% | of EIX Directors are from Diverse Ethnic Backgrounds | 30% | of EIX Directors are Female |

| 60Years | 4.5Years | |||||

| Average Age of EIX | ||||||

| Directors | Average Tenure of EIX | Directors | ||||

| Board Oversight | ||||||

✓Independent Chair of the EIX Board ✓Independent Directors Meet Regularly Without Management Present | ✓ | |||||

| Key Board Committees Composed Solely of Independent Directors | ✓ | |||||

| Board Oversight of Key Enterprise Risks, Including Cybersecurity | ✓ | |||||

| Board Oversight of Political Contributions | ✓ | |||||

| Annual Board and Committee Evaluations | ||||||

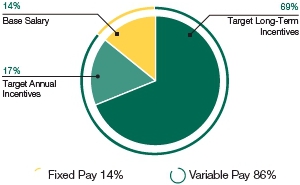

| Executive Compensation | ||||||

✓Majority of Executive Compensation “At Risk” and Aligned with Shareholder Interests | ✓ | |||||

| Quantitative Targets for Most Annual Incentive Plan Goals ✓Incentive Compensation Clawback Policy | ✓ | |||||

| Anti-Hedging and Anti-Pledging Policies | ✓ | |||||

| Stock Ownership Guidelines for Directors and | ||||||

| Shareholder Rights | ||||||

✓Annual Election of Directors | ✓ | |||||

| Majority Voting for Directors in Uncontested Elections | ✓ | |||||

| 10% Threshold for Shareholders to | ||||||

✓Shareholder Ability to Act By Written Consent | ✓ | |||||

| Annual Advisory Vote on Executive Compensation | ✓ | |||||

| Proxy Access for Director Elections | ||||||

| 2017 Meetings | ||||||

✓10 Board Meetings | ||||||

✓6 Independent Director Executive Sessions | ||||||

✓100% EIX Director Nominees Attended at least 95% of | ✓100% | |||||

✓94% of EIX Shareholder Votes Cast in Favor of Executive Compensation | ||||||

Our Shareholder Engagement

We seek and value input from our shareholders. In 2015, we engaged with institutional shareholders holding approximately 30% of EIX common stock to discuss their views on the Company’s corporate governance, proxy disclosure, executive compensation, and environmental and social issues. In particular, we sought specific feedback from shareholders regarding proxy access and sustainability disclosure. Management shared the feedback received from these discussions with the Board and relevant Board committees.

Our Adoption of Proxy Access

After considering feedback from shareholders, in December 2015, the EIX Board adopted proxy access for director elections at annual meetings. The EIX Bylaws provide that the Company will include in its Proxy Statement up to two nominees (or nominees for up to 20% of the EIX Board, whichever is greater) submitted by a shareholder or group of up to 20 shareholders owning at least 3% of EIX common stock continuously for at least three years, if the shareholder group and nominee satisfy the requirements in the EIX Bylaws.

Our Executive Compensation Program

See “Compensation Summary.”

Proposed Amendment to the EIX 2007 Performance Incentive Plan

The EIX 2007 Performance Incentive Plan is EIX’s only equity compensation plan under which new awards may be granted. EIX’s equity awards are designed to attract, retain and reward officers and key employees, and to align executives’ interests with the long-term interests of shareholders. The EIX Board approved the following amendments to the plan, subject to approval by EIX shareholders:

|

|

ITEM 1. ELECTION OF DIRECTORS |

Ten directors have been nominated for election to the EIX Board and 11 directors have been nominated for election to the SCE Board, each to hold office until the next Annual Meeting. The director nominees of EIX and SCE are the same, except that Mr. PizarroPayne is a nominee for the SCE Board only.

A biography of each nominee describing his or her age as of this Proxy Statement, current Board committee service, business experience during the past five years and other relevant business experience is presented below. The biography includes the experience, qualifications, attributes, and skills that led the Board to conclude that the nominee should serve as a director. While each nominee’s entire range of experience and skills is important, particular experience that contributes to the diversity and effectiveness of the Board is identified below.

Director Since2017 Board Committees ●Audit ●Governance Other Public Company Boards ●None | |||

| Michael C. Camuñez Biographical Information Mr. Specific Qualifications and Experience Relevant to the Company Mr. |

| www.edison.com | 5 |

Item 1. Election of Directors

Age Director Since 2007 Board Committees ●Audit ● Other Public Company Boards ● ● ●Transocean Ltd. | |||

| Vanessa C.L. Chang | |||

| Biographical Information Ms. Chang has been a director of EL & EL Investments, a private real estate investment business, since 1999. She previously served as chief executive officer and president of ResolveItNow.com, an online dispute resolution service, senior vice president of Secured Capital Corporation, a real estate investment bank, and a partner of the accounting firm KPMG Peat Marwick LLP. Ms. Chang is a director of Sykes Enterprises, Incorporated and Transocean Ltd., and a director or trustee of Specific Qualifications and Experience Relevant to the Company Ms. Chang brings to the Board experience in accounting and financial reporting and | ||

Age Director Since 2016 Board Committees ●Audit ●Compensation | |||

|  |

ITEM 1: ELECTION OF DIRECTORS

|

| |||

Other Public Company Boards ●Pacific Mutual Fund Complex | James T. Morris Biographical Information Mr. Morris is the chairman, president and chief executive officer of Pacific Life Insurance Company, and its parent companies Pacific Mutual Holding Company and Pacific LifeCorp. He has served as chief executive officer since 2007 and chairman since 2008, and served as president from 2007 to 2012 and again beginning in 2016. Mr. Morris has served in a variety of management positions since joining Pacific Life in 1982, including chief operating officer from 2006 to 2007, executive vice president and chief insurance officer, life insurance and annuities and mutual funds divisions, from 2005 to 2006, executive vice president, life insurance division, from 2002 to 2005, and senior vice president, individual insurance, from 1996 to 2002. In addition, he has been chairman of the board and trustee of the Pacific Select Fund and the Pacific Funds Series Trust, members of the same mutual fund complex, since 2007. Mr. Morris Specific Qualifications and Experience Relevant to the Company

| ||||

|

|

ITEM 1: ELECTION OF DIRECTORSItem 1. Election of Directors

Director Since2017 Board Committees ●Compensation ●FOSO Other Public Company Boards ●FirstGroup plc | Timothy T. O’Toole Biographical Information Mr. O’Toole has been the chief executive officer of First Group plc, a transportation company that provides rail and bus services in the United Kingdom and North America, since 2010. He also serves as a director of First Group plc, which is publicly traded on the London Stock Exchange. Mr. O’Toole is a director of the National Safety Council and previously served as a director of CSX Corporation. He previously served as managing director of the London Underground from 2003 through 2009. Prior to that, Mr. O’Toole served in various senior management roles during his 20 years of service at Consolidated Rail Corporation, including president and chief executive officer from 1998 to 2001. He is a graduate of La Salle University and received his law degree from the University of Pittsburgh. Specific Qualifications and Experience Relevant to the Company Mr. O’Toole brings to the Board public company chief executive leadership experience in a regulated, capital intensive industry. His operational experience in safety, risk and crisis management is particularly relevant to the oversight of our business and strategy. |

Age SCE Director Since Other Public Company Boards ●None | Kevin M. Payne Biographical Information Mr. Payne has been the CEO of SCE since June 2016. Prior to his current role, he served as senior vice president of Customer Service for SCE from 2014 to June 2016. Mr. Payne has held various leadership positions, including Vice President of Engineering and Technical Services from 2011 to 2014, Vice President of Client Services Planning and Controls from 2010 to 2011, Vice President of Information Technology and Business Integration from 2009 to 2010, and Vice President of Enterprise Resource Planning from 2008 to 2009. Prior to that he was a Director in the Renewable and Alternative Power and Major Customer Technical Support departments. Mr. Payne began his career with SCE in 1986 in the Engineering and Construction department managing power plant retrofit and other engineering projects. He has a degree in mechanical engineering from the University of California, Berkeley, and is a registered professional engineer. Specific Qualifications and Experience Relevant to the Company Mr. Payne brings to the SCE Board in-depth knowledge of the Company’s business, experienced leadership, and an engineering background. He also brings senior executive, operations and strategic planning experience developed during his 31 years of service with SCE. |

| www.edison.com | 7 |

Item 1. Election of Directors

Age52 EIX Director Since2016 SCE Director Since2014 Other Public Company Boards ●None | Pedro J. Pizarro Biographical Information Mr. Pizarro has been the President and CEO of EIX since October 2016. Prior to that, he served as President of EIX from June 2016 to September 2016 and President of SCE Specific Qualifications and Experience Relevant to the Company Mr. Pizarro brings to the | ||

| |||

Director Since Board Committees ● ●Governance (Chair) Other Public Company ● |

| ||

|  |

ITEM 1: ELECTION OF DIRECTORS

| Linda G. Stuntz | |||

| Biographical Information Ms. Stuntz has been a partner of the law firm of Stuntz, Davis & Staffier, P.C. since Specific Qualifications and Experience Relevant to the Company Ms. Stuntz brings to the Board utility and environmental law and public policy experience, which is particularly relevant to the Company’s business. Her experience as a director of other public companies, including in the energy and electric utilities industries, also brings value to the Board. |

| 8 |  | 2018 Proxy Statement |

Item 1. Election of Directors

Age Director Since Chair of the EIX Board Board Committees ●FOSO ●Governance Other Public Company Boards ● | |||

| William P. Sullivan | |||

| Biographical Information Mr. Sullivan served as chief executive officer of Agilent Technologies, a global provider of scientific instruments, software, services and consumables in life sciences, diagnostics and applied chemical markets, from 2005 to 2015. In addition, he was Agilent’s president from 2005 to 2012 and 2013 to 2014. Prior to that, Mr. Sullivan was executive vice president and chief operating officer of Agilent from 2002 to 2005. He had been senior vice president and general manager of Agilent’s Semiconductor Products Group from 1999 to 2002. Before 1999, Mr. Sullivan served in various management roles, including in manufacturing and product development, at Hewlett-Packard Company. He serves as a director of Maxim Integrated and previously served as a director of Agilent Technologies, Avnet, Inc. and URS Corporation. Mr. Sullivan is a graduate of the University of California, Davis. Specific Qualifications and Experience Relevant to the Company Mr. Sullivan brings to the Board experience as president and chief executive officer of a large public company. He also brings significant operational experience, including leadership of successful company transformation. This experience, particularly in the technology sector and in product and business development, is very valuable to the Board in the changing electric industry. | ||

Age66 Director Since Board Committees ●FOSO (Chair) ●Governance Other Public Company Boards ● | |||

|

|

ITEM 1: ELECTION OF DIRECTORS

| Ellen O. Tauscher | |||

| Biographical Information Ms. Tauscher serves on the University of California Board of Regents and is Chair of the Boards of Governors of Los Alamos National Security, LLC and Lawrence Livermore National Security, LLC. She has been a strategic advisor with the law firm of Baker, Donelson, Bearman, Caldwell & Berkowitz, PC since 2012. Ms. Tauscher served as Under Secretary of State for Arms Control and International Security from 2009 to 2012. Prior to joining the State Department, she served from 1997 to 2009 as a member of the U.S. House of Representatives from California’s Specific Qualifications and Experience Relevant to the Company Ms. Tauscher brings to the Board extensive government affairs and public policy experience, which is particularly relevant to the Company’s business and valuable in assessing the Company’s strategy. She also brings business and financial acumen. Her experience in national security and in the State Department and in Congress is particularly valuable in the oversight of cybersecurity risk and her role as the Board’s liaison to the Company’s cybersecurity oversight group (see page |

| www.edison.com | 9 |

Item 1. Election of Directors

Age Director Since Board Committees ●Audit (Chair) ● Other Public Company Boards ● | |||

| Peter J. Taylor | |||

| Biographical Information Mr. Taylor has been the president of ECMC Foundation, a nonprofit corporation dedicated to educational attainment for low-income students, since May 2014. Prior to that he served as executive vice president and chief financial officer of the University of California from 2009 to 2014 and managing director of public finance at Lehman Brothers and Barclays Capital from 2002 to 2009. Mr. Taylor is a director of Pacific Mutual Holding Company and the Kaiser Family Foundation, and a member of the Board of Trustees of California State Specific Qualifications and Experience Relevant to the Company Mr. Taylor brings to the Board finance and public policy experience, which is particularly relevant to the Company’s infrastructure investment strategy and highly regulated business. He also brings experience in risk management, accounting and financial reporting, which is valuable in his role as a financial expert | ||

Age Director Since Board Committees ● ● Other Public Company Boards ●None | |||

|  |

ITEM 1: ELECTION OF DIRECTORS

| Brett White | |||

| Biographical Information Mr. White has been chairman and chief executive officer of Cushman & Wakefield (formerly DTZ), a commercial real estate services company, since September 2015. He served as executive chairman of DTZ from March 2015 to September 2015. Mr. White previously served as a senior advisor to TPG Capital, a private equity firm, from July 2014 to December 2014 and as a managing partner at Blum Capital, a private equity firm, from January 2013 to December 2013. Prior to that, he served as chief executive officer of CBRE Group, Inc., a commercial real estate services firm, from 2005 to 2012, president of CBRE Group from 2001 to 2010 and, prior to that, as chairman of the Americas of CB Richard Ellis Services, Inc. Mr. White Specific Qualifications and Experience Relevant to the Company Mr. White brings to the Board the experience, strategic perspective, critical judgment and analytical skills of a chief executive officer of a global company. His real estate services industry experience is particularly relevant to the Company’s infrastructure investment strategy. He also brings the perspective of a business headquartered and doing business in the local markets served by SCE developed from his years of service at CBRE Group. This experience is valuable in Mr. White’s role as the Company’s |

| |||

| The Board recommends you vote |

|

|

ITEM 1: ELECTION OF DIRECTORSItem 1. Election of Directors

| Our Corporate Governance |

How are potential director nominees identified and selected by the Board to become nominees?

The Governance Committee, comprised solely of independent directors under New York Stock Exchange LLC (“NYSE”) rules and our Corporate Governance Guidelines, recommends director candidates to the Board.

The Committee will consider candidates recommended by shareholders if they are submitted in writing to the Corporate Secretary and include all of the information required by Article II, Section 4 of our Bylaws plus a written description with any supporting materials of:

| ● | Any direct or indirect business relationships or transactions within the last three years between EIX and its subsidiaries and senior management, on the one hand, and the candidate and his or her affiliates and immediate family members, on the other hand; and |

| ● | The qualifications, qualities, and skills of the candidate that the shareholder deems appropriate to submit to the Committee to assist in its consideration of the candidate. |

The Committee also considers candidates recommended by our directors, senior management, and director search firms retained by the Committee. Mr. Morris,Messrs. Camuñez, and O’Toole, who is aare first-time director nominee, wasnominees for election by the shareholders at the Annual Meeting, were recommended by the Committee’s director search firm. The search firm supports the process of identifying director candidates, coordinating the interview process and conducting reference checks. There are no differences in the manner in which the Committee evaluates a candidate based on the source of the recommendation.

If, based on an evaluation of the candidate’s qualifications, qualities and skills, the Committee determines to continue its consideration of a candidate, Committee members and other directors as determined by the Committee interview the candidate. The Committee conducts any further research on the candidate it deems appropriate. The Committee then determines whether to recommend that the candidate be nominated as a director. The Board considers the recommendation and determines whether to nominate the candidate for election.

What information does the Governance Committee consider when recommending a director nominee?

For the Committee to recommend a director nominee, the candidate must at a minimum possess the qualifications, qualities and skills in our Corporate Governance Guidelines, including:

| ● | A reputation for integrity, honesty and adherence to high ethical standards; |

| ● | Experience in a generally recognized position of leadership; and |

| ● | The demonstrated business acumen, experience and ability to exercise sound judgment in matters that relate to the current and long-term objectives of the Company. |

The Committee also considers other factors and information, including the Board’s current need for additional members, the candidate’s potential for increasing the Board’s range of experience, skills and diversity, the candidate’s independence, and skills and experience relevant to our business strategy.

In nominating candidates for re-election to the Board, the Committee also considers the nature and time invested in a director’s service on other boards, the director’s Board, Board committee and annual meeting attendance, and the vote received at the prior annual meeting. The Corporate Governance Guidelines limit a director’s service on other boards to three other public company boards.

www.edison.com 11

Item 1. Election of Directors

How does the Governance Committee consider diversity in identifying director candidates?

Our Corporate Governance Guidelines state the Board’s policy that the value of diversity on the Board should be considered. The Committee considers ethnic and gender diversity, and diversity of skills, backgrounds and qualifications represented on the Board, in recommending nominees for election. The Committee has instructed its director search firm to identify candidates reflecting ethnic and gender diversity.

The Committee evaluates its effectiveness in achieving diversity on the Board through its annual review of Board composition, which identifies ethnicity, gender and industry experience prior to recommending nominees for election.

How does the Board determine which directors are independent?

Our Corporate Governance Guidelines require that the Board be comprised of at least a majority of independent directors and that the Audit, Compensation, and Governance Committees be comprised entirely of independent directors. The Company uses the NYSE listing standards to determine independence.

Directors serving on the Audit and the Compensation Committees must meet additional independence criteria prescribed by the NYSE listing standards and the charters of those Committees. Director Chang serves on the audit committees of the American Funds family, Sykes Enterprises, Incorporated and Transocean Ltd., and may serve on the audit committee of Sykes Enterprises, Incorporated. The Board has determined Ms. Chang’s simultaneous service on the audit committees of three other public companies woulddoes not impair her ability to effectively serve on our Audit Committee.

The Board has determined that the relationships described in Section B of Exhibit A-1 to our Corporate Governance Guidelines, which are on our website atwww.edison.com/corpgov, are not material for purposes of determining directors’ independence to serve on the Board. The Board does not consider thesesuch relationships in making independence determinations to serve on the Board.determinations.

For relationships not prohibited by NYSE rules and not covered under the categories of immaterial relationships in our Guidelines, the determination of whether a relationship is material or not, and therefore whether a director is independent to serve on the Board or not, is made in good faith by the directors. The director whose relationship is under consideration abstains from the vote regarding his or her independence.

|  |

ITEM 1: ELECTION OF DIRECTORS

Which directors has the Board determined are independent to serve on the Board?independent?

The Board has determined that all directors and director nominees other than Messrs. CraverPizarro and PizarroPayne are independent to serve on the Board.independent. The Board previouslyalso determined that Messrs. Freeman, Nogales and Sutton,Louis Hernandez, Jr., who retiredresigned from the Board on April 23, 2015, wereFebruary 27, 2018, was independent.

The Board reviews the independence of our directors to serve on the Board or an independent Board committee at least annually, and periodically as needed. On a monthly basis, the Company also monitors director relationships and transactions that might disqualify them as independent. In February 2016,2018, prior to recommending director nominees for election, the Board confirmed that the independent directors had no relationships or transactions that disqualified them as independent to serve on the Board.independent.

| 12 |  | 2018 Proxy Statement |

Item 1. Election of Directors

Who is the Lead DirectorChair of the Board and what are the Lead Director’sChair’s duties and responsibilities?

The Lead Director is designated annually byMr. Sullivan has served as the independent directors, must be independent, and is expected to devote a greater amountChair of time tothe EIX Board service than the other directors. The current Lead Director is Mr. White, who has served in that role since April 2014.

The Lead Director’s duties and responsibilities are described in our Corporate Governance Guidelines and include:October 2016.

As independent Chair, Mr. Sullivan’s duties include: ● | ●With the ●With the Governance Committee, oversee the annual evaluations of ●Be the principal liaison in synthesizing and communicating to the |

●With the | |

| and ● | |

The Lead Director’s termSCE Bylaws provide that the CEO of SCE has the duties of the Chair unless a separate Chair of the SCE Board is one year, consistent with annual electionsappointed. Since June 2016, Mr. Payne has served as SCE CEO and has had the duties of directors; however, our Lead Directors have served for at least two years since 2008.the Chair of the SCE Board.

Why does the Board believe its Board leadership structure is appropriate?

The EIX Board believes having Mr. Craver serve inseparating the combined role of ChairmanChair and CEO with an independent Lead Director havingpositions is the duties described above, provides anmost appropriate balance between effective leadership structure for EIX at this time, by allowing Mr. Pizarro to focus on the day-to-day management of the Companybusiness and on executing our strategic priorities, while allowing Mr. Sullivan to focus on leading the Board, providing advice and counsel to Mr. Pizarro, and facilitating the Board’s independent oversight of management. The EIX Board has the following corporate governance practices that provide for strong independent leadership on the Board and effective oversight of management and CEO performance:

The EIX Board also believes having Mr. Craver serve in the combined role of EIX Chairman and CEO is in the best interests of our shareholders because:

The EIX Board continues to monitor trends and could reach a different conclusion on the appropriate Board leadership structure under different circumstances.

The SCE Bylaws provide that the President of SCE has the duties of the Chairman. The Lead Director of EIX also serves as Lead Director of SCE. All directors of SCE are independent, except for Messrs. Craver and Pizarro, and the key Board committees are composed entirely of independent directors. The SCE Board has determined that the current leadership structure is appropriate for SCE as a subsidiary of EIX. All directors of SCE are independent, except for Messrs. Payne and Pizarro, and the key Board committees are composed entirely of independent directors.

What is the Board’s role in CEO succession planning?

The Board believes CEO succession planning is one of its most important responsibilities. Our Corporate Governance Guidelines provide that the Board will annually review and evaluate succession planning and management development for the Company’s senior officers, including the CEO.

|

|

ITEM 1: ELECTION OF DIRECTORS

At least annually, the Board meets in executive session with the EIX CEO to discuss talent and succession planning. The discussion includes CEO succession in the ordinary course, CEO succession if an emergency occurs, and succession for other key senior management positions. The frequency of the Board’s CEO succession planning discussions depends in part on the period of time until the CEO’s expected retirement.

In the succession planning process, internal CEO succession candidates are identified and evaluated based on criteria considered predictive of success at the CEO level, considering the Company’s business strategy. The Board uses a common talent assessment format for each individual. The assessment includes a development plan for each individual.

Our Corporate Governance Guidelines provide that the Board will have opportunities to become acquainted with the senior officers of the Company and others who may have the potential to handle significant management positions. This is carried out through opportunities for officers to make presentations to the Board and Board committees, director education sessions, other business interactions, and social events intended for this purpose.

www.edison.com 13

Item 1. Election of Directors

What is the Board’s role in strategy oversight?

The Board is regularly engaged in providing management with strategic direction, including but not limited to opportunities in clean energy, efficient electrification, strengthening and modernizing the electric grid, and customer choice. The Board’s oversight and review of Company strategy occurs through annual in-depth strategy meetings, annual education sessions on strategic topics with external experts, regular updates at Board meetings, and discussion of emerging issues affecting strategy. Directors with particular expertise in a strategic area also advise management on strategy outside of Board meetings. In 2017, the Board education sessions on strategic topics focused on technology drivers for an integrated energy network and SCE’s pathway for clean power and electrification.

What is the Board’s role in risk oversight?

Our Corporate Governance Guidelines provide that one of the Board’s primary functions is to review the Company’s enterprise risk management process and monitor strategic and emerging risks. The Board annually reviews key enterprise risks identified by management, such as financial, reputational, safety, physical and cyber security, and compliance risks, and monitors key risks through reports and discussions regarding key risk areas at Board meetings. The Board also focuses on specific strategic and emerging risks in periodic strategy reviews. The Board annually reviews corporate goals and approves capital budgets.

Board committees have responsibility for risk oversight in specific areas as follows:

The Audit Committee is responsible for oversight of (i) risk assessment and risk management policies, (ii) major financial risk exposures, and (iii) the steps management has taken to monitor and control these exposures. The Committee reviews the Company’s risk management processes and key enterprise risks, reviews the EIX risk management committee charter, receives regular reports on litigation, internal audits and compliance, receives “deep dive” reports on specific risk topics at meetings, and receives semi-annual reports of the Company’s political contributions. The Committee also annually reviews and approves the internal audit plan. The EIX Vice President for Risk Management regularly attends Committee meetings and reports on risk issues.

The Compensation Committee assesses and monitors risks in the Company’s compensation program. The Committee’s risk assessment process and factors considered in assessing risk are discussed under “How We Make Compensation Decisions - Risk Considerations” in the Compensation Discussion and Analysis below.

The FOSO Committee is responsible for oversight of risks in the Company’s capital investment activities and operations. The Committee regularly monitors the level of capital spending relative to approved capital budgets and must approve significant capital spending variances and projects not included in approved capital budgets. The Committee also monitors safety and operational performance metrics, significant developments related to safety, physical and cyber security, reliability and affordability, and the availability of resources in these areas. The Committee receives “deep dive” reports on key topics related to its responsibilities.

The Governance Committee advises the Board regarding Board size and composition, Board committee composition and responsibilities, Lead Director selection and corporate governance practices that help position the Board to effectively carry out its risk oversight responsibility.

| Audit Committee | ||

| Responsible for oversight of (i) risk assessment and risk management policies, (ii) major financial risk exposures, and (iii) the steps management has taken to monitor and control these exposures. The Committee reviews the Company’s risk management processes and key enterprise risks, reviews the EIX risk management committee charter, receives regular reports on litigation, internal audits and compliance, receives “deep dive” reports on specific risk topics at meetings, and receives semi-annual reports of the Company’s political contributions. The Committee also annually reviews and approves the internal audit plan. The EIX Vice President of Enterprise Risk Management regularly attends Committee meetings and reports on risk issues. | ||

| Compensation Committee | ||

| Assesses and monitors risks in the Company’scompensation program. The Committee’s riskassessment process and factors consideredin assessing risk are discussed under “HowWe Make CompensationDecisions -RiskConsiderations” in the Compensation Discussionand Analysis below. | ||

| Governance Committee | ||

| Advises the Board regarding Board size and composition, Board committee composition and responsibilities, selection of the independent Chair of the EIX Board, the Board and Committee self-evaluation process, and other corporate governance practices that help position the Board to effectively carry out its risk oversight responsibility. | ||

| FOSO Committee | ||

| Responsible for oversight of risks in the Company’s operations and capital investments, allocation and spending. The Committee regularly monitors the level of capital spending relative to approved capital budgets and must approve significant capital spending variances and projects not included in approved capital budgets. The Committee also monitors safety and operational performance metrics, significant developments related to safety, physical and cyber security, reliability and affordability, and the availability of resources in these areas. The Committee receives “deep dive” reports on key topics related to its responsibilities. | ||

The Board believes its leadership structure supports the Board’s risk oversight function. Independent directors chair the Board committees responsible for risk oversight, the Company has an independent Lead DirectorChair of the EIX Board who facilitates communication between management and directors, and all directors are involved in the reviewdirectors.

| 14 |  | 2018 Proxy Statement |

Table of key enterprise risks.Contents

Item 1. Election of Directors

What is the Board’s role in cybersecurity oversight?

The Company has identified cybersecurity as a key enterprise risk. Cyber risks are included in the key risk reports to the Board and Audit Committee discussed above. In addition, the Board has assigned primary responsibility for cybersecurity oversight to the FOSO Committee, which receives cybersecurity updates with each meeting that focus on the Company’s most critical assets, cybersecurity drills, exercises, mitigation of cyber risks, and assessments by third-party experts. In 2015,2017, the Board also received a cybersecurity and business resiliency report with a similar focus on reducing the Company’s cybersecurity risks.

The Company has established a cybersecurity oversight group comprised of a multidisciplinary senior management team to provide governance and strategic direction for the identification, protection and detection of cybersecurity risks to the Company. Director Tauscher serves as the Board liaison to the oversight group and regularly attends meetings. Other Board members attend at least one meeting annually.

What is the Board’s role in oversight of environmentalESG issues?

The Board oversees climate change and social issues?other ESG risks and opportunities as an integrated part of its strategy oversight responsibility, which includes annual in-depth strategy meetings and regular updates at Board meetings.

EnvironmentalBoard committees comprised entirely of independent directors have responsibility for risk and social policies have a significant impact on the Company’s business and strategy. As a result, the Board is regularly engaged inoperational oversight of environmental and socialspecific ESG-related issues related to the Company’s operations, including:as outlined below.

| Board Level ESG Oversight | ||

Specific areas of oversight include: ●Environmental legislation and regulation related to renewable energy, distributed generation, transportation electrification, energy efficiency, and climate change; ●Implications of regulatory proceedings and decisions for Edison International’s climate change strategy and objectives; ●Risks arising from climate-related events, including wildfires, that impact our business; ●Engagement with stakeholders on climate change and other ESG concerns; ●Board approval of capital budgets, incorporating capital allocation decisions for grid modernization, transportation electrification, and energy storage; and ●Board approval of corporate goals related to safety, reliability, grid modernization, capital spending, and diversity, each of which advance the Company’s strategy. | ||

| Audit Committee | ||

| ||

●Key risks related to wildfires and climate change ●Key risks related to reliability, safety and public policy ●Political and charitable contributions | ||

| FOSO Committee | ||

●Capital spending ●Workforce and public ●Electric system reliability ●Cybersecurity | ||

|  | ||

●Incentive compensation plans and goals ●Executive diversity | |||

| Governance Committee | ||

●Board composition and diversity ●ESG corporate governance trends ●Shareholder outreach efforts on ESG issues | ||

www.edison.com 15

ITEM 1: ELECTION OF DIRECTORSItem 1. Election of Directors

TheAs discussed above, in 2017, we engaged with shareholders holding approximately 34% of EIX Common Stock to discuss our Board oversees environmentaloversight and social issues that impactCompany disclosure related to ESG issues. We received feedback on information used by shareholders to evaluate ESG practices and their desired disclosure, and shared this feedback with the Company’s business, regulatory requirements, and reputation. Risks associated with environmental and social issues are identified in key risk reports to the Board and AuditGovernance Committee. The Audit Committee also oversees the Company’s political and charitable contributions.

DoHow do the Board and Board committees evaluate their performance?

TheIn 2017, the Board and Board committees completecompleted an annual self-evaluation questionnaire and discussdiscussed the results of their evaluation in executive session during the applicable Board or committee meeting. Directors havehad the opportunity to provide feedback on the performance of other directors during this process. The Governance Committee oversees the annual evaluation of the Board and Board committees.committees and periodically reviews the effectiveness of the process.

| The Governance Committee has decided to retain a facilitator to assist in the 2018 Board and committee evaluations. The facilitator plans to interview each director. The results of the evaluation and any recommendations for improvement will be discussed with the Governance Committee and the Board. |

How many times did the Board meet in 2015?2017?

The Board met nineten times in 2015.2017. Each current director attended 75% or moreat least 95% of all Board and Board committee meetings he or she was eligible to attend. The Board held six executive sessions of the independent directors.

Does the Company have a policy on attendance of Director nominees at Annual Meetings?

Director nominees are expected to attend Annual Meetings while retiring directors are not.Meetings. All of the current EIX and SCE directorsdirector nominees attended the 20152017 Annual Meeting.

Are directors required to hold EIX Common Stock?

Within five years from their initial election to the Board, directors must own an aggregate number of shares of EIX Common Stock or derivative securities convertible into EIX Common Stock, excluding stock options, having a value equivalent to five times the annual Board retainer. All deferred stock units held by a director count toward this ownership requirement.

All directors comply with this stock ownership requirement.

Has EIX adopted proxy access for director elections?

In December 2015, the EIX Board adopted proxy access for director elections at annual meetings. The EIX Bylaws provide that the Company will include in its Proxy Statement up to two nominees (or nominees for up to 20% of the EIX Board, whichever is greater) submitted by a shareholder or group of up to 20 shareholders owning at least 3% of EIX common stock continuously for at least three years, if the shareholder group andnomineeand nominee satisfy the requirements in Article II, Section 13 of the EIX Bylaws, which are available atwww.edison.com/corpgov. The EIX Board made this decision after careful consideration of feedback received from our engagement with shareholders regarding proxy access.

| Key Proxy Access Terms | ||||

| 3%ownershiprequired continuously for3years | Up to 20 shareholders may aggregate their shares to reach the 3% ownership requirement | Up to 2 nominees or20% of the Board, whichever is greater. | ||

| 16 |  | 2018 Proxy Statement |

Item 1. Election of Directors

Does EIX have a policy on shareholder rights plans?

The EIX Board has a policy to seek prior shareholder approval of the adoption of any shareholder rights plan unless, due to time constraints or other reasons consistent with the EIX Board’s fiduciary duties, a committee consisting solely of independent directors determines that it would be in the best interests of EIX shareholders to adopt the plan prior to shareholder approval. Any rights plan adopted by the EIX Board without prior shareholder approval will automatically terminate one year after adoption of the plan unless the plan is approved by EIX shareholders prior to such termination.

Is SCE subject to the same corporate governance stock exchange rules as EIX?

EIX is subject to NYSE rules and SCE is subject to NYSE MKT LLC rules, which exempt SCE from designated corporate governance rules for Board and Board committee composition, including director independence, the director nominations process, and the process to determine executive compensation.

SCE is exempt from these rules because (i) it is a “controlled company” with over 50% of the voting power held by its parent company, EIX, and (ii) it has listed only preferred stock on the exchange. However, SCE closely follows the EIX corporate governance practices required under the NYSE rules.

How may I communicate with the Board?

Shareholders and other interested parties may communicate with the Board or individual directors by following the procedures on our website atwww.edison.com/corpgov.

Where can I find the Company’s corporate governance documents?

The EIX Bylaws, Corporate Governance Guidelines, and Board committee charters, the Ethics and Compliance Code for Directors applicable to all directors of EIX and SCE, and the Employee Code of Conduct applicable to all EIX and SCE officers and employees, are on our website atwww.edison.com/corpgovcorpgov..

The SCE Bylaws, Corporate Governance Guidelines and Board committee charters are on our website atwww.sce.com/corpgovcorpgov..

|

|

ITEM 1: ELECTION OF DIRECTORS

| Certain Relationships and Related Transactions |

It is the Company’s policy that theThe Governance Committee reviewreviews at least annually, and periodically as needed, any transaction in the prior calendar year or any proposed transaction between the EIX companies and a related person in which the amount involved exceeds $120,000 and the related person has a material interest. A related person is a director, a director nominee, an executive officer, or a greater than 5% beneficial owner of any class of voting securities of EIX or SCE, and their immediate family members. This policy is stated in writing in the Committee’s charter.

The Committee’s regular procedure is to obtain from management annually, and periodically as needed, a list of the transactions with related persons described above, and to review these transactions at a meeting held before recommending director nominations to the Board. The list is based on information from questionnaires completed by our directors, director nominees, and executive officers, together with information obtained from our accounts payable and receivable records, and is reviewed by legal counsel. The Committee’s procedure is evidenced in the minutes and records for the Committee meeting at which the review occurred.

Director Linda Stuntz is an equity partner at the law firm of Stuntz, Davis & Staffier, P.C. (“SD&S”), which paid the Company approximately $210,448$209,848 in 20152017 to sublease office space in Washington, D.C. The Company’s sublease of office space to SD&S began before Ms. Stuntz joined the Board.

| www.edison.com | 17 |

Item 1. Election of Directors

| Board Committees |

The current membership and key responsibilities of our Audit, Compensation, Governance, and FOSO Committees are below. The duties and powers of each Committee are further described in its charter. The Board occasionally creates special Board committees to focus on certain topics.

Audit Committee

| |||

| ●Appoint, compensate and oversee the Company’s independent registered public accounting firm (the “Independent Auditor”), including: ●Review the Company’s financial statements and financial reporting processes, including internal controls over ●Oversee the Company’s internal audit function, including the General Auditor’s performance, the internal audit plan, budget, resources and staffing. ●Oversee the Company’s ethics and compliance program, including the Chief Ethics and Compliance Officer’s performance, ●Discuss the Company’s policies and guidelines with respect to major financial and key enterprise risk exposures, risk assessment and management, and the steps taken to monitor and control these risks. ●Establish and maintain procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters. ●Review the Company’s political contribution policies and expenditures and approve contributions that exceed $1 million. | ||

| Peter J. Taylor* Chair Other Members: |

*Audit Committee |  |

ITEM 1: ELECTION OF DIRECTORSCompensation and Executive Personnel Committee

| ||||

| ●Review the performance and set the compensation of designated elected officers, including the executive officers. ●Review director compensation for consideration and action by the Board. ●Approve the design of executive compensation programs, plans and arrangements. ●Approve stock ownership guidelines for officers and recommend ●Review and assess whether any risks arising from compensation policies and practices are reasonably likely to have a material adverse effect on the Company. | |||

| Brett White Chair Other Members: | ||||

| Meetings in 2017:3 | ||||

| 18 |  | 2018 Proxy Statement |

Item 1. Election of Directors

Nominating/Corporate Governance Committee

| ||||

| ●Periodically review Board size and ●Make recommendations to the Board regarding Board committee and committee chair assignments and ●Review related party transactions. ●Periodically review and recommend updates to the Corporate Governance Guidelines and Board committee charters. ●Advise the Board with respect to corporate governance matters. ●Oversee the annual evaluation of the Board and Board committees. ●Review the orientation program for new directors and continuing education activities for all directors. | |||

Other Members: | ||||

| Meetings in | ||||

Finance, Operations and Safety Oversight Committee

| Key Responsibilities: ●Review and monitor capital spending and investments in subsidiaries compared to the annual budget approved by the Board, and receive post-completion reports from management on ●Monitor operational and service excellence performance metrics. ●Monitor significant developments relating to safety, reliability and affordability, specifically including cybersecurity, business resiliency and emergency response, and the availability of appropriate resources to achieve objectives in these areas. ● ● | ||

| Ellen O. Tauscher Chair Other Members: | |||

Meetings in 2017: 5 | |||

|

|

ITEM 1: ELECTION OF DIRECTORSItem 1. Election of Directors

| Director Compensation |

The following table presents information regarding the compensation paid for 20152017 to our non-employee directors. The compensation paid to any director who is also an employee of EIX or SCE is presented in the EIX and SCE Summary Compensation Tables and the related explanatory tables.

Director Compensation Table – Fiscal Year 20152017

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(1)(2) ($) | Option Awards(3) ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Non-Qualified Deferred Compensation Earnings(4) ($) | All Other Compensation(5) ($) | Total ($) | |||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||||

| Jagjeet S. Bindra | $128,250 | $125,050 | — | — | — | $10,000 | $263,300 | |||||||||

| Vanessa C.L. Chang | $145,500 | $125,050 | — | — | $19,912 | $10,000 | $300,463 | |||||||||

| Bradford M. Freeman(6) | $57,500 | — | — | — | $33,879 | — | $91,379 | |||||||||

| Luis G. Nogales(6) | $36,500 | — | — | — | $4,078 | — | $40,578 | |||||||||

| Richard T. Schlosberg, III | $132,750 | $125,050 | — | — | $38,071 | $10,000 | $305,871 | |||||||||

| Linda G. Stuntz | $115,500 | $125,050 | — | — | $1,291 | $5,000 | $246,842 | |||||||||

| William P. Sullivan | $83,250 | $125,050 | — | — | — | $10,000 | $218,300 | |||||||||

| Thomas C. Sutton(6) | $48,500 | — | — | — | $22,929 | — | $71,429 | |||||||||

| Ellen O. Tauscher | $129,625 | $125,050 | — | — | $1,010 | — | $255,685 | |||||||||

| Peter J. Taylor | $125,500 | $125,050 | — | — | — | $10,000 | $260,550 | |||||||||

| Brett White | $155,500 | $125,050 | — | — | $18,057 | $10,000 | $308,607 |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(1)(2) ($) | Option Awards(3) ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Non-Qualified Deferred Compensation Earnings(4) ($) | All Other Compensation(5) ($) | Total ($) | |||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | |||||||

| Jagjeet S. Bindra(6) | $68,500 | — | — | — | — | $10,000 | $78,500 | |||||||

| Michael C. Camuñez | $85,750 | $101,327 | — | — | — | — | $187,077 | |||||||

| Vanessa C.L. Chang | $113,250 | $135,068 | — | — | $38,370 | $10,000 | $296,688 | |||||||

| Louis Hernandez, Jr.(6) | $113,250 | $135,068 | — | — | $3,258 | — | $251,576 | |||||||

| James T. Morris | $115,250 | $135,068 | — | — | $4,064 | — | $254,382 | |||||||

| Timothy T. O’Toole | $58,250 | $67,521 | — | — | $427 | — | $126,198 | |||||||

| Richard T. Schlosberg, III(6) | $62,500 | — | — | — | $27,705 | — | $90,205 | |||||||

| Linda G. Stuntz | $126,500 | $135,068 | — | — | $4,676 | $7,500 | $273,744 | |||||||

| William P. Sullivan | $179,750 | $197,500 | — | — | — | — | $377,250 | |||||||

| Ellen O. Tauscher | $128,500 | $135,068 | — | — | $1,068 | $10,000 | $274,636 | |||||||

| Peter J. Taylor | $135,250 | $135,068 | — | — | — | $5,000 | $275,318 | |||||||

| Brett White | $130,750 | $135,068 | — | — | $36,361 | — | $302,179 |

| (1) | The amounts reported for stock awards reflect the aggregate grant date fair value of those awards computed in accordance with FASB ASC Topic 718. For a discussion of the assumptions and methodologies used to calculate the amounts reported, see Note 8 (Compensation and Benefit Plans) to |

| (2) | Each non-employee director, other than Messrs. |

| (3) | We |

| (4) | Amounts reported consist of interest on deferred compensation account balances considered under SEC rules to be at above-market rates. |

| (5) | EIX has a matching gift program that provides assistance to qualified public and private schools by matching dollar-for-dollar gifts of at least $25 up to a prescribed maximum amount per calendar year for the Company’s employees and EIX and SCE directors. The amounts in this column reflect matching gifts made by EIX pursuant to this |

| (6) | Messrs. |

| 20 |  |

|  |

ITEM 1: ELECTION OF DIRECTORSItem 1. Election of Directors

Annual Retainer and Meeting Fees

Compensation for non-employee directors during 20152017 included an annual retainer, fees for attending certain meetings, and an annual equity award. Directors were offered the opportunity to receive all of their compensation on a deferred basis under the EIX Director Deferred Compensation Plan.

The Board changed the cash compensation for non-employee directors effective July 1, 2015, in accordance with the recommendation of the Compensation Committee and the advice of Pay Governance LLC (“Pay Governance”), the independent compensation consultant for the Compensation Committee. The Board eliminated fees for attending shareholder, Board and Board committee meetings, increased the annual Board retainer from $65,000 (or $16,250 per quarter) to $110,000 (or $27,500 per quarter), and increased the retainers paid to the Chairs of the FOSO and Governance Committees by $2,500 (or $625 per quarter). Pay Governance advised the Compensation Committee that most S&P 500 companies do not pay directors meeting fees for attending shareholder, Board or Board committee meetings, and that the increase in the annual Board retainer approximately equaled the annual value of the eliminated meeting fees. The Board retained the $2,000 fee for attending any other business meeting on behalf of the Company as a director, if attended at the request or invitation of the Chairman.

The following table sets forth the cash retainers and meeting fees paid to directors in 2015 (directors only received one meeting fee for any concurrent meetings attended by the director):2017:

| Type of Fee | Jan. to June 2015 | July to Dec. 2015 | ||||

| Board Retainer Per Quarter | $16,250 | $27,500 | ||||

| Additional Board Retainer Per Quarter to: | ||||||

| • | Audit Committee Chair | $5,000 | $5,000 | |||

| • | Compensation Committee Chair | $3,750 | $3,750 | |||

| • | Other Committee Chairs | $2,500 | $3,125 | |||

| • | Lead Director | $6,250 | $6,250 | |||

| Fee Per Meeting: | ||||||

| • | Shareholder/Board/Committee | $2,000 | N/A | |||

| • | Other Business Meeting | $2,000 | $2,000 | |||

| Type of Fee | Jan. to Sept. 2017 | Oct. to Dec. 2017 | |||

| Board Retainer Per Quarter | $27,500 | $28,750 | |||

| Additional Board Retainer Per Quarter to: | |||||

| ● | Audit Committee Chair | $5,000 | $5,000 | ||

| ● | Compensation Committee Chair | $4,375 | $4,375 | ||

| ● | Other Committee Chairs | $3,750 | $3,750 | ||

| ● | Chair of the EIX Board | $15,625 | $15,625 | ||

| Fee Per Meeting:(1) | |||||

| ● | Shareholder/Board/Committee | N/A | N/A | ||

| ● | Other Business Meeting | $2,000 | $2,000 | ||

| (1) | Directors are not paid meeting fees for attending shareholder, Board or Board committee meetings. They are paid a $2,000 fee for attending any other business meeting on behalf of the Company as a director, such as cybersecurity oversight group meetings (see page 15), if attended at the request or invitation of either the Chair of the EIX Board or the EIX CEO. No director received more than $6,000 in meeting fees in 2017. Directors only receive one meeting fee for any concurrent meetings attended by the director. |

All directors are also reimbursed for out-of-pocket expenses for serving as directors and are eligible to participate in the Director Matching Gift Program described in footnote (5) to the Director Compensation Table above.

Annual Equity Awards

Upon re-electioninitial election or initial electionre-election to the Board in April 2015,2017, non-employee directors were granted an annual equity award of EIX Common Stock (or deferred stock units, as explained below) with an aggregate grant date value of $125,000. Non-employee directors who are re-elected to the Board in April 2016 will be granted an equity award of EIX Common Stock (or deferred stock units) with an aggregate grant date value of $135,000. If a director is initially elected at or after the 2016 Annual Meeting, he or she will be granted an award of EIX deferred stock units with an aggregate grant date value of $135,000 onor a prorated portion thereof (as explained below). Non-employee directors who are elected or re-elected to the Board in 2018 are scheduled to receive an annual equity award with an aggregate grant date value of $140,000 or a prorated portion thereof. Upon initial appointment or re-appointment of a non-employee director as Chair of the EIX Board, the director is granted an additional annual equity award of EIX Common Stock or deferred stock units with an aggregate grant date value of $62,500. If the grant date of an award for an initial election to the Board or initial appointment as Chair of the EIX Board occurs after the date of election.EIX’s Annual Meeting for that year, then the grant date value of the award is prorated by multiplying it by the following percentage: 75% if the grant date is in the second quarter of the year; 50% if the grant date is in the third quarter of the year; 25% if the grant date is in the fourth quarter of the year.

The number of shares or units granted is determined by dividing the grant date value of the equity award ($125,000 or $135,000, as described above) by the closing price of EIX Common Stock on the grant date of election or re-election and rounding up to the next whole share. Each award is fully vested when granted.

DirectorsThe annual equity award for an initial election to the Board is made in the form of deferred stock units. For re-election awards and the additional equity award for appointment or re-appointment as Chair of the EIX Board, directors have the opportunity to elect in advance to receive their re-election awardsuch awards entirely in EIX Common Stock, entirely in deferred stock units, or in any combination of the two. A deferred stock unit is a contractual right to receive one share of EIX Common Stock. Deferred stock units are credited to the director’s account under the EIX Director Deferred Compensation Plan described below. Deferred stock units cannot be voted or sold. They accrue dividend equivalents on the ex-dividend date, if and when dividends are declared on EIX Common Stock. The accrued dividend equivalents are converted to additional deferred stock units.

| www.edison.com | 21 |

Item 1. Election of Directors

Each director’s equity award in 20152017 was granted under the EIX 2007 Performance Incentive Plan. Directors serving on both Company Boards receive only one award per year.year for election to the Boards.

EIX Director Deferred Compensation Plan

The EIX Director Deferred Compensation Plan is separated into two plan documents. The grandfathered plan document applies to deferrals earned prior to January 1, 2005, while the 2008 plan document applies to deferrals earned on or after January 1, 2005. Mr. Schlosberg was the only director in 2017 to have an account balance subject to the grandfathered plan document.